trust capital gains tax rate 2020 table

This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of. The tax rate works out to be 3146 plus 37 of income.

Florida Real Estate Taxes What You Need To Know

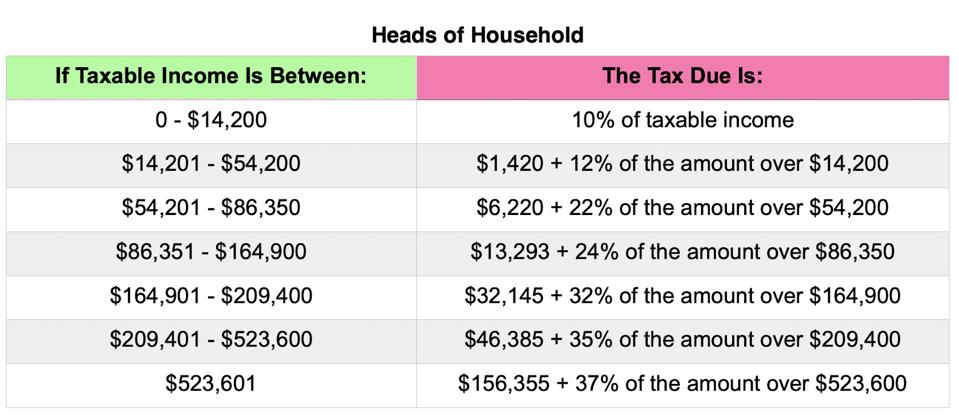

10 percent of taxable income.

. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. Ad Compare Your 2022 Tax Bracket vs.

Discover Helpful Information and Resources on Taxes From AARP. If taxable income is. Net capital gains are taxed at different rates depending on overall taxable income although some or all net capital gain may be taxed at 0.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Short-term capital gains. Estates and Trusts Taxable Income 0 to 2600 maximum rate 0 2601 to 12700 maximum rate 15.

Capital gains tax rates on most assets held for a year or less correspond to ordinary income tax brackets. 255 plus 24 of the excess over 2550. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

The 2020 rates and brackets for the income of an Estate or trust. For tax year 2020 the tax brackets are 10 24 35 and 37. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

The following are some of the specific exclusions. Single Filers Taxable Income Married Filing Jointly. If taxable income is.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Events that trigger a disposal include a sale donation exchange loss death and emigration. Estates and trusts pay income tax too.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. It applies to income of 13450 or more for deaths that occur in 2022. Long-Term Capital Gains Tax Rate.

Income tax is not only paid by individuals. It continues to be important. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to.

Over 2600 but not over. Long-Term Capital Gains Taxes. The rate remains 40 percent.

1839 plus 35 of the excess over 9150. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office. Most single people will fall into the 15 capital gains.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. 2022 Long-Term Capital Gains Trust Tax Rates. Capital gains rates for individual increase to 15 for.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. 10 12 22 24 32 35 or 37. Trust tax rates are very high as you can see here.

A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office. However long term capital gain generated by a trust still. 2021 Long-Term Capital Gains Trust Tax Rates.

The trustees take the losses away from the gains leaving no chargeable gains for the. The highest trust and estate tax rate is 37. The capital gain tax rates for trusts and estates are as follows.

The tax rate schedule for estates and trusts in 2020 is as follows. Ad From Fisher Investments 40 years managing money and helping thousands of families. Your 2021 Tax Bracket to See Whats Been Adjusted.

The tax rate on most net capital gain is no higher than 15 for most individuals. For single folks you can benefit from the zero percent capital gains rate if you have an income below 40000 in 2020. Unlike the bear market of Q4 2018 or the pandemic-induced bear market of.

Tax changes enacted in 2013 included a top tax bracket for trusts of 396 on undistributed income adjusted for inflation latest year amount is shown in the above tax table.

Income Tax Rates Slab For Fy 2012 13 Or Ay 2013 14 Ebizfiling

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Income Tax Rates For Fy 2020 21 Fy 2021 22

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Trust Tax Rates 2022 Atotaxrates Info

Income Tax Rates In Nepal 2079 2080 Corporation Individual And Couple

Average Income Tax Rates Comparisons South African Revenue Service